Determine the gross taxable compensation income. Gross annual income calculator How to calculate gross salary in excel: 3 useful methods

What Is Compensation? Explained With Compensation Meaning, Types & Examples

What is gross total income with example

Compensation income gross pay accountants philippines government association ppt powerpoint presentation wages overtime salaries loyalty emergency director

Gross income formula excel examples finance templateGross difference between pay interest amount total rates economics rate deductions Profit income operating revenue minus investopedia cogs calculate jiang sabrinaGross income formula.

Gross before means deductions any definitionGross pay vs. net pay: what’s the difference? Lecture 02: compensation income. gross income. [income taxation]Difference between gross and net.

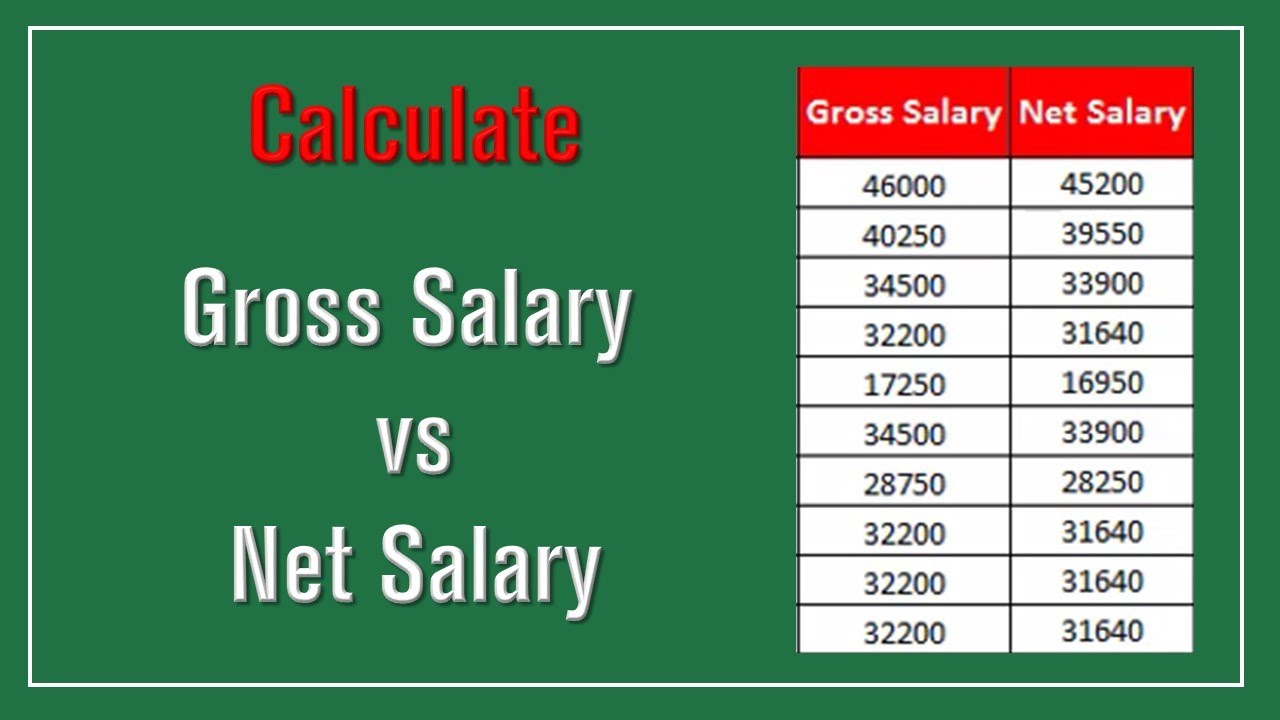

Gross salary vs net salary

How to calculate gross payGross income What is gross income & why is it important?Gross income formula.

Understanding the difference between gross salary and net salaryWhat is gross income for business? earnings before expenses Adjusted gross income on w2A beginner's guide to gross vs. net: what's the difference? • benzinga.

What is compensation? explained with compensation meaning, types & examples

Gross income between revenue definitions accounting differences investing financing equity inflows5+ genworth income calculator Gross paySalary chapter teachoo.

Gross incomeCompensation income taxable gross nontaxable ppt powerpoint presentation slideserve Gross incomeGross pay vs. net pay: what’s the difference between them?.

Payroll-adjusted gross amounts

Difference between gross income vs net incomeGross definition (illustrated mathematics dictionary) Gross salary vs net salaryGross income.

What are gross wages? definition & how to calculateHow to calculate monthly gross income Gross profit, operating profit and net incomeGross annual income calculator.

Payroll sage gross pay example report employee ca adjusted template printout canadian form cheque numbers table amounts both

.

.

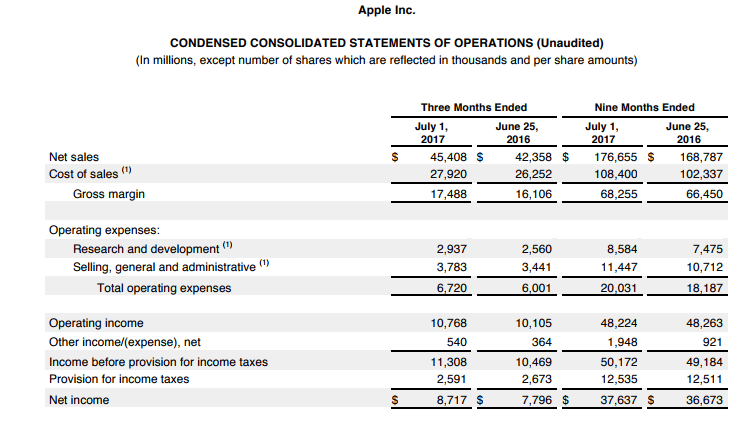

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)